From Clarity to Confidence: Copperleaf’s Transparent Solutions

With advanced technologies, particularly those involving artificial intelligence (AI) and machine learning (ML), the “black box myth” often comes up. This myth perpetuates the idea that these systems operate in ways that are incomprehensible to users.

Copperleaf, an IFS company, harnesses the power of AI alongside our proven value optimization algorithms. This combination enables us to generate a diverse range of investment options and planning recommendations, which are then optimized to identify the highest-value investment plans.

While AI delivers critical insights that enhance asset investment planning (AIP), it complements (rather than replaces) the essential human experience and oversight required to craft optimal investment strategies. This collaboration between AI-driven insights and human expertise ensures organizations can achieve strategic objectives with precision and confidence.

In this post, we’ll demystify how our suite delivers value for our clients.

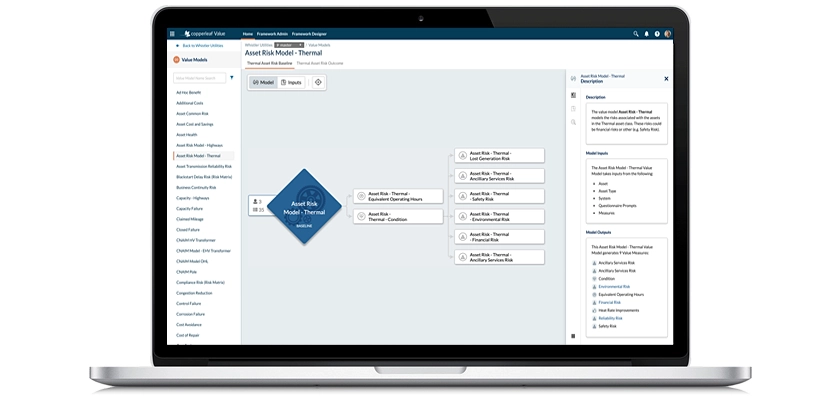

Understanding the Copperleaf Value Framework

At the core of Copperleaf is a robust value framework designed to align asset investment decisions with an organization’s strategic objectives.

This framework is a well-defined structure that quantifies the value of different investment options. Incorporating various value measures—such as financial performance, risk mitigation, and sustainability goals—Copperleaf weighs each measure and compares them on a common economic scale.

Every step of the value framework development process is documented and customizable, allowing users to see exactly how decisions are made. This transparency builds trust and ensures stakeholders can confidently rely on the recommendations provided by the solution.

Optimizing Capital Plans

Our optimization engine evaluates and compares different investment scenarios to determine the most valuable investment plans.

It considers constraints such as budget limits, resource availability, and strategic priorities. By processing extensive data inputs, including historical performance and asset conditions, it simulates potential outcomes to pinpoint the highest-value scenarios, ensuring alignment with strategic objectives.

Users can customize the optimization process, adjusting parameters to meet specific needs. They can also access reports explaining how scenarios were evaluated and why recommendations were made, further establishing the credibility of the insights generated.

Using AI to Enhance Decision Making

Copperleaf uses AI and ML to enhance decision-making processes, using these advanced technologies within our product suite:

-

- Data preparation: Optimize Ready improves data quality and consistency, cleaning and preparing data for analysis. This step ensures the optimization engine runs as effectively and accurately as possible. Optimize Ready uses ML to learn usage patterns to continually improve its recommendations.

- Performance prediction: Copperleaf Performance Prediction uses ML to predict the performance of investment portfolios. By analyzing historical data, ML algorithms can forecast the likelihood of overspending or underspending when plans move to execution. This predictive capability helps organizations anticipate financial variances and adjust strategies accordingly.

- On-demand support: Copperleaf uses AI to deliver quick and thorough help to clients through AI Online Help. The engine interprets user intent to provide the best response based on supporting documentation, speeding up time to resolution.

The Copperleaf product suite is sophisticated, but it’s not a mystery. By providing a clear value framework and using AI and ML in understandable and accessible ways, we empower our clients to make informed, strategic asset investment decisions.

Further developments in our AI and ML capabilities are on the horizon. Tune in to the May session of our Product Learning Series webinar to learn more about the AI capabilities included in our first release of the year.