Businesses today are faced with unprecedented challenges that demand increased investment. However, budgets and resources are more limited than ever before. To thrive, companies must strike the right balance between managing their current business and investing in the future.

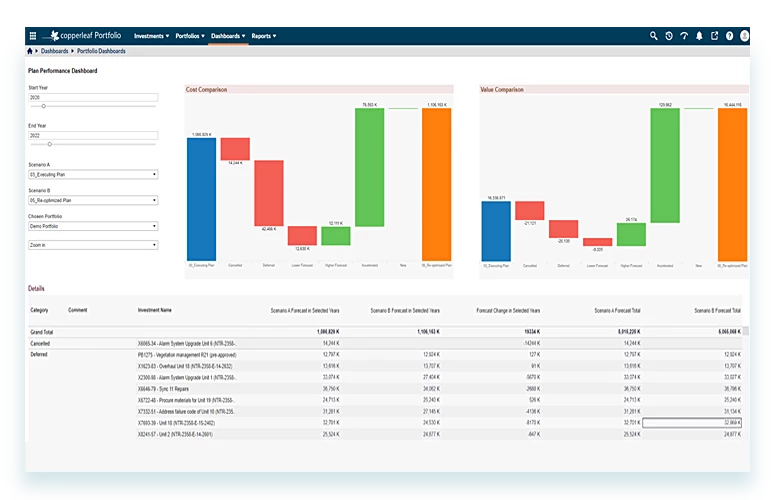

Copperleaf Portfolio™ is a decision analytics solution that enables organizations to create, manage, and communicate the best possible investment plans that maximize return for their businesses. Portfolio equips planning teams with everything they need to ensure their plans will achieve their organization’s operational, financial, and strategic goals.

Receive the most benefit from your spend

Achieving the highest value from your plans means carrying out the right investments at the right time. This is no easy task for organizations with hundreds of candidate investments across business lines.

Copperleaf’s AI-powered optimization evaluates the vast number of possibilities and identifies the highest-value investment plan within minutes. Create any number of what-if scenarios to compare, contrast, and communicate the impact of each approach on cost, risk, value, and other strategic targets.

Spend less time planning and more time doing

Planning teams continue to be challenged by the sheer scale of their planning process. Significant time is regularly required to source, analyse, and manage data across the organization.

Copperleaf Portfolio saves you time by streamlining the process of developing, approving, and managing investments through their full lifecycle. It provides a centralized, enterprise-wide platform to easily capture all investment candidates, allowing them to be consistently scoped, costed, valued, and organized efficiently into portfolios. Planning teams can be confident that their decisions are based on complete and current information from across the organization.

Manage your risk exposure

Without a comprehensive and quantitative risk assessment, you cannot be sure of your organization’s resilience in the face of changing external factors, from cybersecurity breaches to extreme weather events.

Copperleaf Portfolio enables organizations to develop comprehensive plans that ensure ongoing performance and reliability. Any number of risk types can be specified and modeled making it easy to understand your overall risk exposure and how it will evolve over time.

Drive your strategy

To make progress on your strategic goals, you need a way to measure progress and compare approaches. Copperleaf Portfolio leverages the Copperleaf Value Framework to consistently assess the value of every investment and align decisions to the strategic priorities of your organization.

Portfolio quantifies how each investment contributes to the achievement of the organization’s strategic goals. Every investment can be compared based on its total value (including contributions to strategic objectives) so that difficult trade-offs can be made with confidence.