How Project Portfolio Management (PPM) Solutions Differ from Asset Investment Planning (AIP) Solutions

Table of Contents

- Executive Summary

- Introduction

- PPM Solutions

- Copperleaf Portfolio

- Other Considerations

- Conclusion

- About Copperleaf Decision Analytics

1. Executive Summary

The definition of asset management is broad and spans solutions that support different levels of decision making for an organization’s asset base. This white paper attempts to address the question of how Project Portfolio Management (PPM) solutions differ from Asset Investment Planning (AIP) solutions, specifically Copperleaf Portfolio™, to clarify the capabilities and benefits of each, and to explain the advantage of an integrated asset management approach that utilizes both systems.

2. Introduction

Organizations that manage critical infrastructure invest billions of dollars each year, making major decisions each day about how to maintain and expand the infrastructure crucial to our society. These decisions are complex, balancing a wide range of strategic and tactical objectives, such as safety, reliability, cost, levels of service, environmental responsibility, and more.

In today’s asset management landscape, several software solutions are available to help organizations make investment decisions, including Asset Investment Planning (AIP) solutions, which help organizations make complex, longer-term decisions related to budget allocations and investments, and Project Portfolio Management (PPM) solutions, which help organizations manage their overall portfolio performance, including resource allocation, tactical execution, and more.

The goal of this white paper is to clarify the capabilities of AIP solutions, such as Copperleaf Portfolio, and PPM solutions. This paper further illustrates that by combining the two, organizations can develop the most robust methodology of investment decision making and project management across a complete time horizon.

3. PPM Solutions

The information presented in this section is compiled from a review of reference papers and research material, combined with insights from Copperleaf’s 20+ years of experience and leadership in asset management. It summarizes key capabilities and the challenges that can be addressed by PPM solutions.

Gartner defines the capabilities of PPM software as “support[ing] the selection, planning, and execution of different work packages.”1 PPMs are employed by organizations to manage a collection of projects and programs, including selecting and prioritizing project initiatives. By categorizing, prioritizing, and sequencing projects, PPM systems enable decision makers to allocate resources wisely, manage execution risks, and estimate project value and costs accurately. They are important tools for maintaining oversight across a portfolio, often providing dashboard views that grant real-time insight into performance versus budget and schedule for each project within the collective portfolio.

The strengths of PPM systems lie in their ability to enhance decision-making through improved visibility and control over projects, especially near-term and in-flight. They ensure that projects with the highest potential for advancing organizational objectives receive prioritization and appropriate resource allocation. PPM systems are excellent for monitoring the health of projects, flagging potential issues before they escalate, and ensuring governance standards are met. They can greatly improve an organization’s project delivery capabilities by enabling the tracking of metrics and key performance indicators (KPIs), thus contributing to a refined project selection process over time.

PPMs with project execution and work management tools are used to track the details of in-flight projects, and in general, PPMs are most frequently used to facilitate the tactical management and execution of projects planned in the short term. Market-leading PPM solutions offer seamless, real-time integration to project financials, procurement, and resourcing, financial and capacity planning capabilities, gating and workflow functionality, and tight Enterprise Resource Planning (ERP) integration to automatically create operational projects. Integration with ERP systems facilitates visibility into procurement, resourcing, reporting, and actual costs from underlying systems to enable daily project decision making. PPM systems and ERP systems are commonly integrated to allow organizations to leverage the strengths of each platform, enabling seamless data flow, streamlined processes, and holistic visibility across projects and the broader enterprise.

3.1.1 Key Capabilities of PPM Systems

These are the key capabilities of a PPM system:

Project prioritization and management

- Evaluate, select, and prioritize new projects

- Schedule project work packages and track execution through task confirmation and milestones

- Plan project resources based on task efforts, roles and responsibilities

- Integrated reporting of actual costs, efforts and revenues directly sourced from finance and HR

Project financial and logistical management

- Structure projects based on planning, monitoring and controlling needs

- Embed projects into the corporate financial, sales, procurement and asset processes

- Refer to work breakdown structure elements in all financial, sales and procurement process to monitor the whole value flow from project perspective

- Plan required service and materials upfront, trigger procurement and monitor it out of your project

Portfolio management

- Stage/gate process for a structured governance process throughout the entire project lifecycle

- Automated cost and revenue reporting directly integrated with project management, finance and controlling, and human resources

- Realtime insights into project cost and schedule performance on individual and portfolio level

- Release of projects and project phases directly controlled from portfolio management

3.1.2 The Levels of PPM Functionality

Generally, PPMs can be understood as having four levels of functionality:

1. Project Management

At the most foundational level, PPM involves the management of individual projects. At this level, actions include detailed scheduling, resource allocation, budget management, and performance tracking for specific projects. Project managers are actively involved in executing plans, solving problems, and ensuring that their projects align with predetermined criteria of success.

2. Portfolio Management

At the next level, portfolio management involves overseeing a collection of projects or programs to ensure they align with the strategic goals of the organization. Here, actions include reviewing the portfolio for balance and fit, prioritizing projects, allocating resource deployment across the portfolio, and monitoring aggregate risk and return. This level is concerned with achieving the best possible outcome from the portfolio as a whole.

3. Program Management

At the program management level, groups of related projects are managed in a coordinated way to obtain benefits not available from managing them individually. Actions performed at this level can include aligning project teams and resources with overarching program goals, navigating dependencies and interfaces between projects, and managing program-level risks and issues.

4. Strategic Alignment

The highest level of PPM is strategic alignment. This involves ensuring that all projects and programs are directly contributing to the organization’s strategic objectives. Actions include strategic planning, aligning portfolio management with organizational governance models, and making executive-level decisions regarding project and program initiation, continuation, or termination based on financial value, risk, and organizational priorities.

4. Copperleaf Portfolio

4.1 What is Asset Investment Planning?

Verdantix, an independent research and consulting firm, defines AIP as “a data-driven approach to assess and prioritize capital investment strategies over a medium- to long-term period (typically more than a year), allowing organizations to manage assets, meet business-level objectives, reduce the risk of asset failure, and minimize the need for wide variations in capital spending.”

Asset Investment Planning (AIP) systems, such as Copperleaf®, are designed to help organizations plan, manage, and optimize the entire range of their asset-related investments, from large strategic investments to small investments like individual asset sustainment. These systems empower businesses to make data-driven decisions by considering various factors that impact the long-term performance and cost-effectiveness of their assets. The focus is to ensure that each investment in a portfolio is weighed according to its contribution to the organization’s strategic objectives, weighed against risks, and assessed for the value it delivers. AIP systems are often used for long-term planning, providing optimized multi-year plans, whereas PPM systems are often utilized to manage and execute projects occurring in the short-term.

The following diagram provides a high-level comparison of the decision types and timescales for AIP, EAM, PPM, and APM solutions:

Figure 1: An analyst’s view of the asset management landscape

Figure 1: An analyst’s view of the asset management landscape

Considering the distinction between AIP and PPM solutions, PPM systems are invaluable for the management and execution of a portfolio of projects. These systems are primarily used for selecting and prioritizing project initiatives to ensure they align with the strategic objectives and goals of the organization. By categorizing, prioritizing, and sequencing projects, PPM systems enable decision-makers to allocate resources wisely, manage risks, and estimate project values and costs accurately.

AIP systems look beyond individual projects, focusing on multi-year asset lifecycle management, providing insights and forecasts on long-term asset performance. They enable organizations to make informed decisions regarding the allocation of capital and operational expenditure over an extended period. Economic analysis is employed within AIP systems to assess the viability of each potential investment, after which projects and the cumulative investment strategy are optimized against specified strategic directives, balancing financial limitations and regulatory mandates for comprehensive asset management planning.

4.2 What is Copperleaf Portfolio?

Copperleaf Portfolio empowers organizations to efficiently create, manage, and communicate investment plans that deliver the greatest value. Portfolio is equipped with streamlined investment capture and costing tools, AI-enabled portfolio optimization tools, and a value-based decision-making framework to consistently assess the risks, benefits, KPIs, and costs of all potential asset investments and make optimal investment decisions that balance operational needs with long-term strategic objectives.

PPM systems, with their focus on managing a range of projects across the organization, provide a framework for aligning project execution with strategic objectives, optimizing resource allocation, and ensuring that projects are completed on time and within budget. The visibility offered by PPM allows organizations to be agile in responding to changes in project scope, priorities, and market conditions, ensuring that governance standards are adhered to and that the project selection aligns with broader strategic goals.

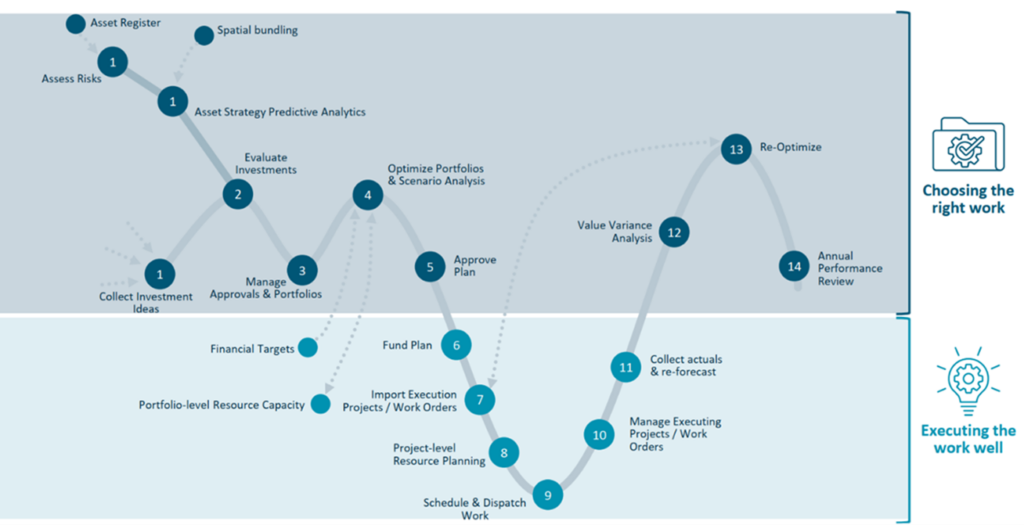

The following image shows the common functionalities of Copperleaf’s AIP software (top) and PPM software (bottom), with AIP chiefly serving to aid in choosing the right work and PPM serving to execute it.

Figure 2: Common split of functionalities between AIP (top) and PPM (bottom)

Figure 2: Common split of functionalities between AIP (top) and PPM (bottom)

By employing a value-based approach to asset investment decisions, Copperleaf Portfolio helps organizations quantify and compare the value of differing investment opportunities, taking into account long-term risks, costs, and performance targets to derive the most value from each investment across the asset lifecycle. Portfolio enhances this decision-making process through advanced scenario analysis, creating robust investment strategies that reflect an organization’s appetite for risk and strategic priorities.

4.2.1 Copperleaf Portfolio Capabilities

Below are the key capabilities of Copperleaf Portfolio:

Scenario generation and analysis

Copperleaf Portfolio includes sophisticated “what-if” scenario analysis that help organizations understand the implications of various investment strategies. By comparing different investment scenarios, decision makers can explore the potential outcomes of any number of potential future events to understand their effects on their investments.

Risk evaluation and management

Portfolio enables users to evaluate and understand the risk exposure of their assets and make decisions that manage those risks in line with their risk appetite. By quantifying risks in monetary terms, Copperleaf Portfolio helps organizations understand which investments will mitigate the most significant risks.

Multi-constraint optimization

Copperleaf Portfolio leverages advanced optimization algorithms designed to maximize value under multiple constraints. This gives organizations the ability to determine the best combination of investments to achieve their strategic objectives while adhering to budgetary, regulatory, and resource limitations. In PPM solutions, only the selected option is entered as a portfolio item (for instance, replacement vs refurbishment of a degraded asset). In contrast, Copperleaf Portfolio captures multiple project alternatives and then leverages optimization to select the appropriate option given organizational constraints and targets.

Asset linked investments

Only Copperleaf Portfolio is capable of linking investments to the assets that they are associated with. This allows investments to properly value the intervention on an asset as its condition changes over time.

5. Other Considerations

The investment of both time and money required to procure and implement an enterprise software solution can be significant. These systems represent important investments to the organization and therefore need to be thoroughly researched and evaluated prior to selection. Along with the investment into a solution, organizations may also consider the following when choosing their desired solutions:

- Costs for implementation resources, training, and ongoing support

- Time frame for implementation

- Stakeholder requirements

- Adaptability to future needs (i.e. the path to updates and upgrades)

5.1 What’s Best for Your Organization?

Organizations recognize that a commitment to any enterprise solution must be well researched, understood, and smartly implemented to create the most value for the business. With the capabilities outlined above, here are the key benefits of each solution to help further understand which adds the most value under which circumstances.

PPM solutions and Copperleaf Portfolio can be complementary systems. Deciding which to implement first is driven by the specific needs of the organization.

5.1.1 PPM Benefits

Implementing a PPM system enhances strategic planning and resource management, leading to improved project execution and alignment with organizational goals. PPM benefits include:

- Managing portfolio balance

- Utilize portfolio analytics to balance the mix of short-term, mid-term, and long-term projects, maintaining organizational focus and adaptability.

- Managing project and portfolio execution risk

- Proactively address potential project pitfalls that could affect timelines, budgets, and resource allocation.

- Implement risk management strategies across the portfolio to minimize exposure and ensure regulatory compliance throughout execution.

- Enhancing resource management

- Streamline resource allocation by identifying and deploying the right talent for the right projects at the right time.

- Cut down on overhead costs by ensuring that resources are optimally utilized, avoiding under or overstaffing scenarios.

- Fostering informed decision making

- Provide executives and project teams with visibility into project performance and portfolio health.

- Leverage data-driven insights to make quicker, more accurate project prioritization and continuation decisions.

- Improving project delivery success

- Establish consistent project management methodologies across the enterprise for better predictability and control

- Increase project success rates through improved planning, execution, monitoring, and collaboration.

5.1.2 Copperleaf Portfolio Benefits

Implementing an AIP solution such as Copperleaf Portfolio supports medium- to long-term strategic asset management decisions and ensures investment plans are aligned with strategic objectives. Copperleaf Portfolio benefits include:

- Executing corporate strategy

- Create investment plans that contribute to the achievement of organizational strategic objectives.

- Align projects to business-as-usual commitments as well as strategic goals such as ESG targets.

- Tailored value framework

- Capture all decision-making criteria and create a common economic scale to allow for the comparison of dissimilar investments.

- Industry-best value models can be customized and expanded to best represent evolving business priorities.

- Comprehensive scenario analysis

- Easily create any number of scenarios and compare each plan in terms of revenue impact, risk, cost, resource usage, service metrics, and alignment with strategic goals.

- Explore and compare options to respond to internal/external disruptions to your plan and perform sensitivity analysis to ensure adequate spending on your most critical investments.

- Proactively managing risk exposure

- Create, analyze, compare, and select investment strategies that maximize value while proactively managing risk.

- Improving planning efficiency

- Leverage AI and automated risk and value calculations to create high-value plans with decreased cycle time and effort, considering any number of “what-if” scenarios to explore the potential impacts of different investment strategies while planning.

- Quickly adapt investment plans to handle requests for change or unforeseen events like emergent work or budget cuts.

- Leveraging data sources

- Data from GIS, EAM, and/or APM systems can be used to improve asset investment planning.

5.2 A Comprehensive Asset Investment Planning Approach

While organizations often must decide to implement either an AIP or PPM solution first based on their immediate priorities, leading organizations end up implementing both. Together, AIP and PPM solutions provide a total asset investment management environment that elegantly handles both short-term project execution management and medium- to long-term strategic investment planning.

Combining the advantages of PPM and AIP enables organizations to seamlessly integrate short-term project execution with long-term asset strategy. For example, by aligning the prioritization and resource allocation informed by PPM systems with the value-focused investment strategy shaped by Portfolio, organizations can ensure that every project contributes effectively to organizational goals. By using both systems in tandem, organizations benefit from a holistic view that not only manages current projects for strategic alignment but also plans for future investments to optimize the performance and longevity of assets.

By integrating AIP and PPM systems, organizations gain complete visibility into the investment lifecycle. The benefits of an integrated approach include:

- Strategic alignment throughout investment lifecycle

- Copperleaf Portfolio ensures investments are aligned with strategic objectives from the planning stage, and PPMs support execution of strategically aligned projects.

- Comprehensive risk mitigation

- Portfolio evaluates risk during investment planning, and PPM systems evaluate project risk through execution.

- Optimized resource allocation

- PPM systems are adept at allocating human and financial resources to the right projects at the right time. Portfolio additionally allocates resources optimally over time, maximizing the overall value and impact across the organization over an extended time horizon.

- Unified portfolio view and performance tracking

- The integration of Copperleaf Portfolio with a PPM system allows organizations to have a unified view of their projects and assets, enabling them to track performance, spend, and value in a consolidated dashboard for more accurate progress tracking and performance reporting.

- Improved stakeholder communication and reporting

- Portfolio offers powerful visualization and reporting capabilities for asset investments, and PPM systems typically possess similar functionalities for projects. Through integration, organizations can deliver cohesive and transparent communication to stakeholders about the status and strategic alignment of investments.

6. Conclusion

Both AIP solutions such as Copperleaf Portfolio and PPM solutions can provide significant value to organizations managing critical infrastructure. To decide which solution is the higher priority for your organization, you should consider over which time horizon improved decision making will provide more value.

PPM systems are typically oriented towards project execution efficiency and are versatile across various time horizons, though they often excel in short- to medium-term planning windows, supporting the effective management of projects in-flight and scheduled in the near future. Copperleaf Portfolio is especially effective in long-term planning, excelling in forecasting the future needs of assets over their entire lifecycle — decades into the future. When used in concert, these two systems can provide comprehensive oversight across all time horizons, ensuring short-term operational efficiency dovetails with long-term strategic asset management objectives, and that all timeframes are optimized to deliver the maximum value to the organization.

7. About Copperleaf Decision Analytics

The Copperleaf Decision Analytics Solution helps organizations decide where and when to invest in their businesses to maximize capital efficiency, meet performance targets, manage risk, and achieve their strategic goals. It empowers organizations to:

Proactively manage risk exposure

- Explore how different levels of investment impact risk

- Identify assets that pose the greatest risk and plan proactive interventions to manage the business

to an agreed risk profile - Model how risk and value change over time to understand the consequences of deferring or

advancing projects

Improve planning efficiency

- Evaluate all investment requests using well-defined, repeatable, and transparent processes to build a robust, defensible plan

- Reduce the time and effort needed for justifications and approvals

- Integrate short-, mid-, and long-term planning horizons in one system

Allocate funding and resources with confidence

- Identify the optimal combination of investments that will deliver the most value and drive your

strategic goals - Develop executable plans that respect available resource constraints

- Create what-if scenarios to understand the trade-offs of different strategies and adapt quickly to shifting priorities

Execute corporate strategy

- Align investment decisions with your strategic objectives, including financial, net-zero, ESG, risk mitigation, KPIs, and other targets

- Track progress toward strategic goals and update assumptions to continuously improve

Copperleaf’s product suite can be used collaboratively across your entire enterprise as the system of record for asset investment planning. Our solutions can integrate seamlessly into your IT environment to connect disjointed systems and data, and bring rigor, discipline, and transparency to the decision-making process.