How do you determine the right portfolio of investments that effectively manages risk and builds resilience?

Investment planners in the water sector must make complex decisions to ensure funding is allocated effectively. Understanding the impact of each investment requires significant effort, time, and resources that cannot be supported by traditional planning tools or spreadsheets.

That’s why water and wastewater companies are rapidly adopting Asset Investment Planning (AIP) solutions to create long-term asset investment strategies that drive the highest value in line with strategic goals.

Mastering Asset Investment Planning in the Water Sector

With aging assets and limited resources, companies often struggle to decide which projects should get the most attention. The ability to compare different investments and better understand the trade-offs is vital for organizations to make better decisions.

Learn how AIP empowers organizations in the water sector to deliver more value to stakeholders by optimizing decision making.

White Paper

Utility Week Explains: Decision Analytics for Net Zero and ESG

Brochure

Decision Analytics for Water Utilities

Video

Planning For The Long Term

ISO 55000: Maximizing Value through Asset Investment Planning

ISO 55000 standards, launched in 2014, guide organizations in maximizing asset value by balancing risk, cost, and performance. ISO 55001 specifically focuses on creating the most value through optimal asset management activities. These standards ensure alignment with organizational goals and efficient decision making.

Learn how Copperleaf supports a risk-informed and value-based approach to investment decision making in alignment with ISO 55001.

Webinar

Webinar: Accelerating Investment Planning Excellence – Affinity Water’s Story

Blog

Interview: Q&A on the Go Live of Copperleaf Portfolio at Northumbrian Water Group

Blog

Guest Post: South Staffs Water – Optimising Our Investment Needs with Copperleaf

Case Study Video: Enabling Continuous Planning and Management at Anglian Water

Implementing Copperleaf has given Anglian Water multiple strategies to forecast the long-term needs of its assets based on economics and risk—enabling them to visualize future asset demands and develop investment strategies to smooth out funding, resource requirements, and maximize the value of their asset portfolio.

Brochure

Copperleaf Asset Investment Planning & Management

Virtual

Webinar: Asset Investment Planning and Management – The Copperleaf Approach

May 31, 2023 | Online Event

News

South Staffs Water Selects Copperleaf to Optimize Investment Planning through Price Reviews and AMP Periods

Drive Strategy through Value-based Decisions

Understanding how to most-effectively realize your organizational strategy can be challenging. The key lies in making the “right” decisions about how to optimally deploy your organization’s valuable resources to achieve strategic objectives.

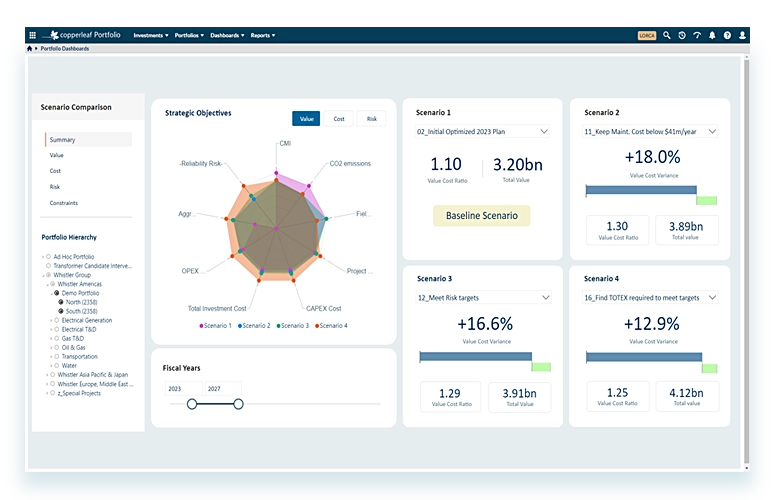

Copperleaf defines the “right” decisions as the investment decisions that will help you realize strategic outcomes in the shortest time, and in the most cost-effective and efficient way possible.

This concept applies to decisions around capital allocation, and sizable non-routine expenses that drive your business performance. It also includes sustainment and growth investments in your infrastructure, assets, IT platform, fleet, facilities, and people—as well as the trade-offs within and across these areas.

Aligning Investment Decisions with Organizational Goals

For regulated industries, developing and defending plans requires an enormous amount of time and resources. From initial planning to final approval, the regulatory landscape can shift, extreme weather events and changing customer expectations can affect priorities, and budgets can fluctuate.

Copperleaf clients find innovative ways to streamline regulatory submissions, justify their investment plans, and react quickly and confidently when circumstances change:

Find the Best Asset Investment Planning Software for Your Business

Copperleaf is a Leader in the Verdantix Green Quadrant Report

Are you navigating the complex landscape of AIP software and looking for the best solutions to meet your business needs?

The Verdantix Green Quadrant for Asset Investment Planning Software is an industry-leading report that provides a comprehensive comparison of top software providers, evaluating them across critical criteria such as functionality, ease of use, and strategic alignment.

Download this report to get:

- Expert Insights: Understand the strengths and weaknesses of leading software solutions

- Benchmarking Data: Compare the capabilities of different tools against industry standards

- Strategic Guidance: Learn how top companies are using AIP software to optimize portfolios and drive better business outcomes

Equip your organization with the knowledge to choose the right software that will maximize ROI, enhance decision making, and align investments with long-term goals.

Download your complimentary copy of the Verdantix Green Quadrant Report.