As the energy transition accelerates, how can electric utilities transform Asset Investment Planning (AIP) processes to overcome challenges and take advantage of emerging opportunities?

Climate change, aging infrastructure, new technologies, digital transformation initiatives, and Environmental, Social, and Governance (ESG) commitments demand increased investment. Electric utilities are executing multi-pronged strategies to safeguard and evolve the resilience of their systems—pursuing decarbonization and a zero-carbon grid, ramping up renewable sources, protecting assets from climate-related events, and defending against cybersecurity threats—while continuing to deliver safe, reliable, and affordable energy to customers.

Copperleaf® helps many of the world’s largest electrical utilities thrive in this environment—by striking the right balance between cost-effectively managing business-as-usual activities and investing for the future.

How can you be confident you’re making the best decisions that deliver the greatest value and drive your strategic goals?

With aging assets and limited financial and human resources, companies often struggle to decide which projects should get the most attention. The ability to compare different investments and better understand the trade-offs is vital for organizations to make better decisions. Learn how AIP empowers organizations to deliver more value to stakeholders by optimizing decision making.

Blog

Six Key Components of an Asset Management System—And Why it Matters

White Paper

Driving Strategy Through Value-based Decisions

How Asset Performance Management (APM) Solutions Differ from Asset Investment Planning (AIP) Solutions

ISO 55000: Maximizing Value through Asset Investment Planning

Released in January 2014, the ISO 55000 international standards aim to maximize value realization from assets. This achievement requires organizations to effectively balance risk, cost, and performance. The standards provide guidance and assurance that the right things are being done right, and that your asset management activities support your organization’s mission and objectives.

In the case of ISO 55001, the right things to do will collectively create the most value for the organization, given the costs, risks, and performance objectives. Organizations must evaluate investments based on how they contribute to corporate objectives. AIP efficiently identifies the optimum mix and timing given a variety of investments or interventions and their alternatives, and any organizational or timing constraints.

Learn how Copperleaf supports a risk-informed and value-based approach to investment decision making in alignment with ISO 55001.

White Paper

A Best Practice of ISO 55000: Asset Investment Planning and Management

White Paper

Value-based Decision Making: A Best Practice of ISO 55000

Webinar

Webinar: ISO 55000 Planning: A Guide to Getting Started

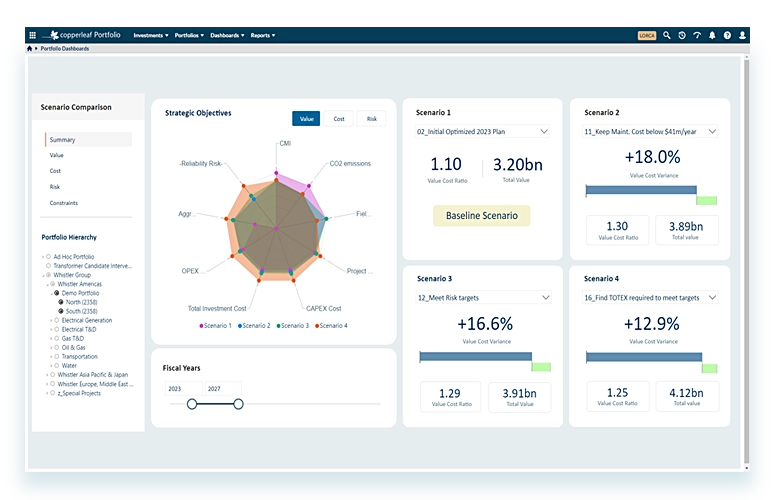

Easily build realistic investment plans with AI-powered optimization

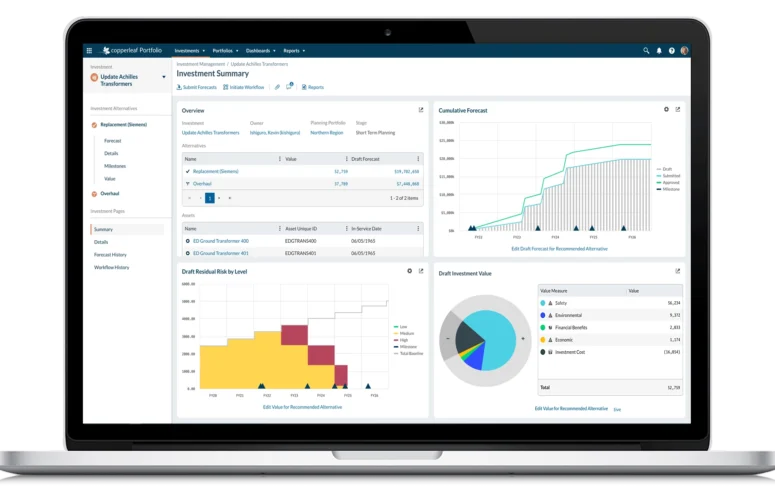

Asset-based organizations invest billions of dollars every year to make major decisions about how to maintain and expand the infrastructure critical to our society. These decisions are complex, balancing disparate factors like safety, reliability, cost-effectiveness, levels of service, and environmental responsibility.

There’s only so much you can do in a spreadsheet. That’s why many of the world’s leading organizations trust Copperleaf’s decision analytics solutions to help manage risk, deliver against performance expectations, and achieve strategic objectives. Learn how Copperleaf is helping organizations get more value out of every decision:

Hydro One Case Study: Creating Investment Plans that Build Stakeholder Trust

Brochure

Copperleaf Asset Investment Planning & Management

Case Study

Sustainable Asset Investment Planning at Endeavour Energy

Webinar

Webinar: Developing a Sustainable Approach to Grid Modernization Investment Planning

Drive Strategy through Value-based Decisions

Understanding how to most-effectively realize your organizational strategy can be challenging. The key lies in making the “right” decisions about how to optimally deploy your organization’s valuable resources to achieve strategic objectives.

Copperleaf defines the “right” decisions as the investment decisions that will help you realize strategic outcomes in the shortest time, and in the most cost-effective and efficient way possible.

This concept applies to decisions around capital allocation, and sizable non-routine expenses that drive your business performance. It also includes sustainment and growth investments in your infrastructure, assets, IT platform, fleet, facilities, and people—as well as the trade-offs within and across these areas.

Value-based decision making in power transmission and distribution

Webinar

Chasing the Holy Grail: Improve Cost, Reliability & Safety at the Same Time

Video

Navigating the Complexities of Electrical Distribution with Copperleaf Asset

Webinar

Webinar: Value, Values & Asset Management Decision Making

The Utility Perspective: Navigating the Evolving Regulatory Landscape

Regulated utilities must strike the right balance between cost-effectively managing business-as-usual activities and investing for the future—while complying with ever-changing regulatory requirements.

Developing investment plans that accomplish these objectives takes innovative thinking and rigorous planning to satisfy and earn trust from internal and external stakeholders.

Learn how value-based decision making can help you:

- Consistently and fully assess the benefits of any project or investment—based on economics and risk

- Align decision making to your company’s evolving strategic objectives

- Identify the optimal set of investments, alternatives, and timing that will deliver the greatest value while respecting all constraints

White Paper

Driving Strategy Through Value-based Decisions

Blog

Value-Based Decisions: Bringing Science to the Art of Decision Making

Blog

RNG on How Copperleaf Helps with Value-based Decision Making

Why Do You Need a Value Framework?

How do you figure out if you’re making the right decisions when you need to compare hard costs versus soft benefits? How do you decide if an incremental improvement in reliability justifies the cost?

Decision making gets even more difficult when you need to compare a portfolio of investments such as:

- investments designed to increase system reliability

- investments that increase wind or solar capacity

- investments that mitigate environmental or safety risks

- infrastructure investments that improve operational efficiency?

To objectively compare these investments, you need a value framework.

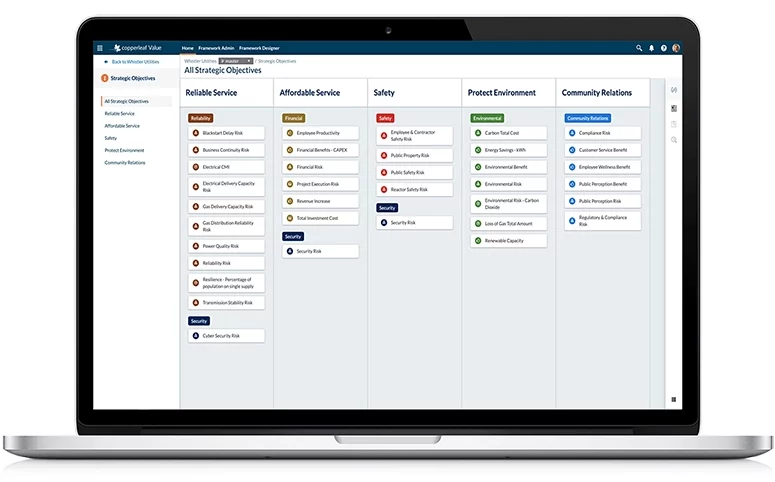

Copperleaf uses a value framework to help organizations quantify all the benefits of an investment—and the probability and timing of achieving such benefits. Quantifying benefits, and gaining agreement on the value of benefits, allows you to fairly and objectively consider all various investment impacts.

A value framework also helps create internal alignment, because internal stakeholders will be able to clearly see and understand why decisions are being made, and how they align to the company’s strategic objectives.

Blog

Innovation @ Copperleaf: How the Value Model Library Helps Organizations Make Better Decisions

Blog

Incorporating Service Levels Into a Value Framework

Video