Maximize the value of your capital allocation decisions

Effective capital allocation is crucial for maximizing value and achieving strategic objectives. Organizations must make informed, data-driven decisions about where to invest limited capital resources to meet expectations for ROI, shareholder value, business expansion, revenue, ESG goals, and more.

Despite having an investment process in place, many organizations lack an optimal capital allocation framework to guide investment decisions that maximize value and achieve their goals.

Copperleaf® offers a new solution to this challenge. within an end-to-end investment and portfolio management environment, organizations can look beyond tactical decision making to address strategic capital allocation. As a part of the IFS platform, Copperleaf provides unprecedented access to deep, data-based insights, extending beyond standard investment management to incorporate value-based decision making into capital strategies.

Offering a comprehensive approach to CAPEX performance management, Copperleaf ensures every investment decision is grounded in the principle of value creation, achieving the highest ROI possible.

Base your decisions on value

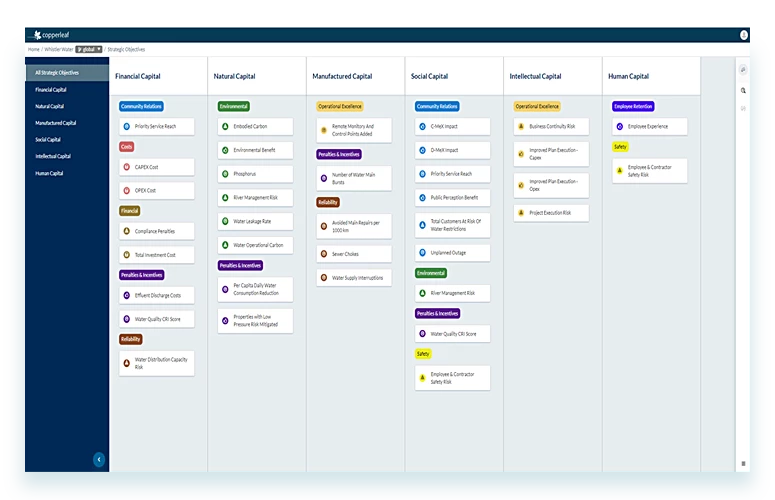

The Copperleaf Value Framework assesses investments based on diverse value measures to put what’s important to your organization at the forefront of your decision making. AI-powered portfolio optimization identifies the highest value investments within funding and timing constraints, ensuring capital is deployed to maximize ROI and strategic outcomes.

Start asking “what if?”

The best capital allocation decisions are made by considering all investment options and assessing the impact of potential future changes. Companies need to explore multiple “what-if” scenarios to understand risks associated with fiscal changes, inflation, regulatory requirements, ESG mandates, or other factors. Copperleaf enables organizations to quickly create and analyze any number of what-if scenarios, comparing different funding constraints and fiscal parameters to visualize future spend pathways and determine the most profitable plan.

End-to-end CAPEX management

Copperleaf offers comprehensive support for CAPEX management, providing complete transparency and defensibility across CAPEX requests and approvals. Users manage configurable workflow processes for business, divisional, and group approvals, as well as change control approvals. Stakeholders gain visibility into portfolio budgets and expected financial outcomes, and actual performance data is incorporated, enabling early identification of potential over or underspending to enhance overall financial control and strategic decision-making.

Sophisticated financial modelling

Copperleaf offers advanced financial modelling capabilities that provide a comprehensive view of CAPEX, OPEX, and revenue, ensuring a complete analysis of your ROI aligned to your corporate strategy. Utilizing modular financial value models, Copperleaf delivers a consistent approach to calculating financial metrics and aggregating outputs into complete financial projections. Organizations can pre-define repeatable values, such as repair and maintenance cost per running hour of equipment, standardizing financial modelling and enhancing the end-user experience. This modular approach, combined with automated workflows, ensures accuracy and efficiency in financial planning.