Why is making investment decisions a challenge?

Every day, companies around the world are spending billions on the infrastructure we all rely on—the electricity that powers our communities, the water that keeps us healthy, and the transportation infrastructure that moves us. These decisions must balance a wide range of considerations, from safety and reliability, to climate resilience, to environmental and social responsibility. Should you spend your limited funds and resources on the sustainment of your current asset base or invest in other areas to help your business grow and prepare for the future? The answer is both. But what’s the right balance? Which projects are urgent and need immediate attention versus those that are important but can be tackled at a later date?

If your organization is struggling with any of the following challenges, Copperleaf® can help.

No quantitative link between spending and strategic objectives, including ESG targets

No way to evaluate financial and non-financial benefits on equal footing

Too much time spent entering data and “number crunching”

Intuition and internal politics influence project selection decisions

Inconsistent processes to select investments; inability to defend portfolio decisions

Inability to respond quickly to the unexpected, e.g. emergent work, regulatory requirements

Best-in-Class AI-Powered Decision Analytics

Copperleaf is at the forefront of investment planning and decision-making. We help clients get the highest possible return for every investment they’re making in their businesses. Our solution is being used to manage infrastructure across multiple industry sectors in more than 25 countries.

in infrastructure managed globally

improved plan execution

increase in capital portfolio value

Centralized, intelligent environment for decision-making

Many organizations are making multi-million dollar decisions based on Excel spreadsheets, standalone tools, or personal qualitative opinions, which can lead to errors, uncertainty, and suboptimal plans and business outcomes.

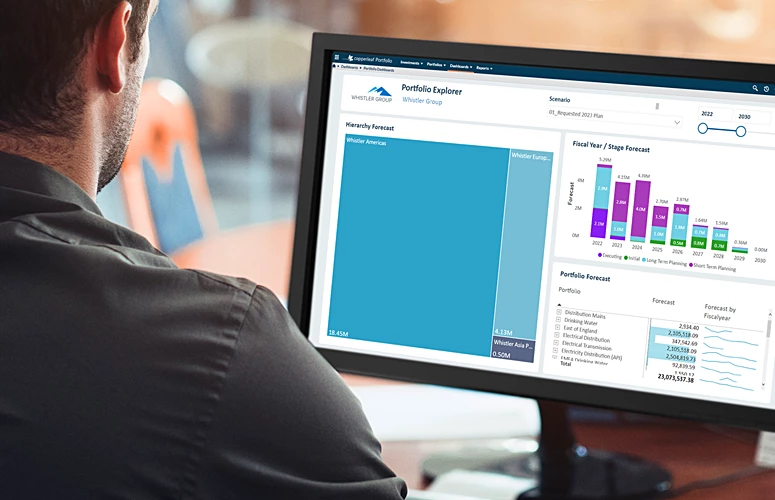

Copperleaf’s suite of enterprise software solutions enable a holistic end-to-end planning process that connects “bottom-up” asset analytics with “top-down” strategic planning at the portfolio level.

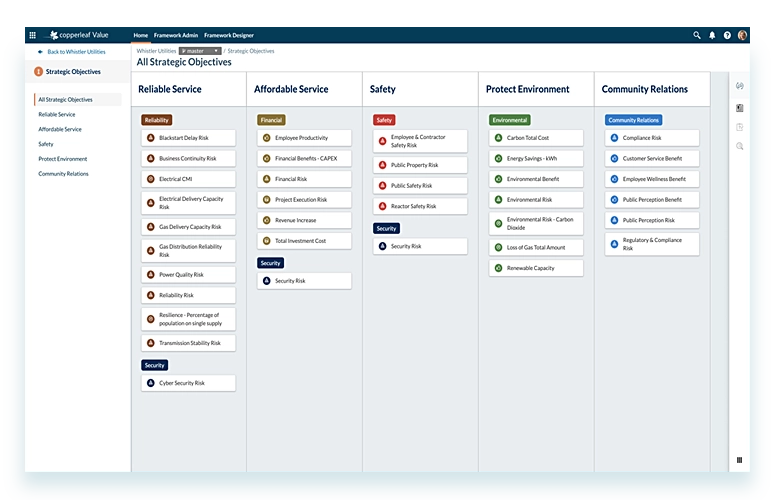

Copperleaf Value Framework

The goal of any organization is to achieve its strategy quickly and cost-effectively. The Copperleaf Value Framework makes it possible to assess the value of every investment consistently—and make decisions that drive the strategic priorities of your organization. Any number of value measures can be added, including financial and non-financial benefits, risks, KPIs, ESG factors, and more, so that even the most dissimilar investments can be compared on a common economic scale.

AI-powered optimization

Delivering the highest value means doing the right projects at the right time. This is no easy task for organizations that deal with hundreds of potential investment options, with multiple alternatives and start dates to consider.

Copperleaf’s AI-powered optimization can evaluate the vast number of possibilities and identify the optimal plan within minutes. Sensitivity analysis can easily be performed to explore the impact of different funding, timing, and resource constraints on value and risk, and build a realistic, deliverable plan to achieve your strategic goals.

Copperleaf Value Model Library

The breadth and diversity of our client base has allowed us to build the Copperleaf Value Model Library. This extensive, evolving collection of best practice models demonstrates the effectiveness of our decision-making solutions in real-life business scenarios. This library is growing and evolving every day as more clients join the community, creating a network effect of knowledge sharing that benefits the entire community today and into the future.

Proven approach to meeting ESG goals

Copperleaf helps organizations turn aspirational ESG objectives into action by offering a practical way to incorporate ESG metrics into everyday decision-making—and identify optimal portfolios of projects to satisfy investors, regulators, and other stakeholders. Here’s how:

- Expand business cases to include ESG measures

- Embed ESG in your organization’s decision-making approach

- Demonstrate the highest-value plan to stakeholders with confidence

Value-based Decision Making

In this video, members of the Copperleaf Community—including Anglian Water, Hydro One, National Grid, and PwC—discuss how Copperleaf’s value-based decision-making approach helps organizations maximize the value of every dollar they spend and create optimal plans for the future.

Explore by Role

Copperleaf helps organizations integrate information and align goals across multiple departments. This reduces decision-making bias, enabling optimal, data-driven decisions across the entire organization. Find out how Copperleaf can support your role.

Discover our client success stories

Organizations managing critical infrastructure trust Copperleaf to help them allocate their funds and resources towards the most valuable areas of their businesses.

Case Study

Video

Hydro One Case Study: Creating Investment Plans that Build Stakeholder Trust

Case Study

Sustainable Asset Investment Planning at Endeavour Energy

Case Study